Features

Find your cup of tea. 🍵

Buzzword time!

Do you like buzzwords?

🖥️ Point of sale (POS)

🛣️ Your way

📙 Auditable logs

⏳ Save time

🗃️ Enterprise resource planning (ERP)

🌱 Growth & Evolve

🧩 Feature-rich APIs

🏅 Win-Win

🚚 Reliable delivery channel

🔑 Amazon AWS KMS

🪙 Hidden values

🎨 Custom theme

✨ User experience (UX)

🐕 Team

🪪 Access controls & Permissions

📱 Direct app integration

🏍️ Customizable

🛎️ Customer service

🛡️ FIPS 140

🫱🏻🫲🏽 Companionship

📦 Durable storage

Each word is an index; look out for its icon.

The basics

What is the service?

We assist in generation, secure storage, and effective management of your documents.

Specifically

e-TaxInvoice &

e-Receipt.

How can I utilize your services?

Our services are accessible through 🧩 application programming interfaces (APIs).

In essence, we offer our services as a software module that integrates with your existing software systems.

This includes 🗃️ ERP systems, 🖥️ POS,

📱 websites or applications.

The integration requires software development expertise to link your system with our services.

What if our company doesn't have a software developer? Can we still use your services?

Not everyone is operating a tech company; no worries!

Whether you're running a restaurant or any other business, there might still be a solution for you.

Head to 🖥️ the

Hybrid Tax Invoice

part and see if that works for you.

If our company already has software developers, why should we use your services?

Utilizing our services can significantly reduce your ⏳ time-to-market.

Moreover, since the service is 🏅 the core value of our product,

we have the resources to achieve a higher standard than what you might achieve in-house.

Meanwhile, receipts are very unlikely to be 🏅 the core value of your product.

Additionally, consider comparing our pricing

with your 🪙 development costs.

If you still want to proceed with your venture, we wish to invite you to be 🫱🏻🫲🏽 our competitors;

we are also willing to provide any necessary information to assist you in kicking start your business.

Bearer Tax Invoice

Elevator pitch

Bearer Tax Invoice converts the cumbersome part of your business

into a breeze of a tailwind for all parties involved.

It's akin to hiring a competent manager to handle tax invoices,

catering to both producers and consumers,

regardless of your role in the transaction.

Brief

Similar to a Bearer Cheque,

which can be cashed or deposited by anyone holding it,

a Bearer Tax Invoice allows anyone holding it to be named on the full tax

invoice.

Technically, it is an abbreviated tax invoice that can

transform itself into a full tax invoice at any time.

This functionality is embedded in the document through a QR code and a link.

🛎️ The conversion process is managed as part of our service,

requiring no additional actions from you,

the API consumer.

What is an abbreviated tax invoice?

If you don't know already,

an abbreviated tax invoice (ใบกำกับภาษีอย่างย่อ) is the minimum-required document

you must provide to your customers when your business operates within the Thai tax system (VAT).

Unlike a full tax invoice, an abbreviated tax invoice does not require customer information.

In other words, it is a tax invoice that you can issue without asking your customer for their data.

As a business owner, how does it upgrade my business?

It's fascinating how the same dish is enjoyable

to many people with different backgrounds and preferences.

While we don't know what your business exactly is,

we can present two scenarios as showcases for you.

Bearer Tax Invoice can help with different aspects of each scenario.

-

First scenario:

At your restaurant, when a customer requests a full tax invoice, you currently issue them a paper one.To do this, your staff has to:- Ask the customer for their information.

- Input customer data into the POS system.

- Print out the document and hand it to the customer.

This process typically takes around 3∽5 minutes per transaction (or more).-

During this time frame,

your staff could alternatively 🛎️ attend to more tables

or 🪙 take a break to replenish their energy. - Your staff can make mistakes, and some customers might not be the type that tolerates them; they might even have reasonably-sounded arguments considering 🪙 the consequences caused.

- The material to print a full tax invoice alone might exceed the asking price for our service.

Bearer Tax Invoice would:- 🛎️⏳ Freeing your staff from the duty.

- 🪙 Eliminate the possibility of mistakes caused by your staff.

- ⏳ Settle the document fast, 🏅 keeping your customer happy and 🏅 making your table available.

- Potentially saving costs on the material alone or, better, 🪙 saving huge costs considering everything else.

If you are interested in using a bearer tax invoice at your restaurant, we have an even better API for your use case, 🖥️ Hybrid Tax Invoice; it is similar to a bearer tax invoice, but the QR code can be embedded on your existing paper-based abbreviated tax invoice. -

Another scenario:

On your 📱 e-commerce website, you issue e-TaxInvoices (not bearer tax invoices) when a customer requests one.Disclaimer: This is a hypothetically common scenarios, we did not claims all of our audiences are this bad. You might address some of the issues on your website already.The subsequent steps outline a naive method to implement e-TaxInvoice functionality into a website or application.- During the checkout process, inquire whether the customer wants to receive an e-TaxInvoice.

- If the customer says yes, direct them to another form to input their information into the tax invoice. Also, ask for their preferred e-mail address for document delivery.

- Subsequently, the customer completes the form and returns to the checkout page. Continuing with the checkout process, they typically proceed to the payment stage.

- Once the transaction is finalized, initiate the generation of the e-TaxInvoice and dispatch it to the e-mail address provided by the customer in the earlier form.

If the steps look all right to you, I bet you never get feedback from the data generated by real users. There are multiple issues during the process; ✨ let's break them down and try to understand them.-

Prior to step 1, the

main objective

of the user is to finalize their purchase.

In step 2, a

sub-objective shows up;

the objective is to handle information that will be shown on the tax invoice.

- This fairly complex objective has multiple consequences and requires some mental capacity.

- We, some tech junkies, probably programmers, do not bat an eyelid when facing multiple objectives. But does this apply to all users, especially older people who have not grown up with gaming and the internet and have been trained all their lives to focus on one thing at a time?

-

In step 2

- Do you remember your company's full address? How about the company's Tax ID?

- How about some younger or older customers; do you think all of them remember their national id number?

-

See your analytics data; they don't lie.

- Good analytics software will show you the user funnel. The info you look for should be between steps 1, 2, and 3.

- There are drops in conversion rates there, aren't they?

-

To understand the result on the screen,

✨ we have to understand what happened off the screen.

- People who exhaust their mental capacity forget their original objective, give up, and getting back to Netflix.

- People who lack complete information to fill out the form go look for them. Some never come back, abandoning their cart.

- The user drops would never have happened if the application never contained step 1 of this procedure in the first place.

-

When considering e-mails, they aren't the most reliable delivery channel, are they?

- When users input their e-mail addresses, they sometimes make a typo; this can also lead to unintentional personal data leakage.

- E-mails may land in the spam folder and get deleted automatically thereafter if not unspam by the customer.

- Worse, some customers solely rely on app notifications to check their e-mails, and some don't even know where or how to examine the spam folder.

- Whenever your customers don't receive the document or think they don't, most don't understand the complex nature of e-mail systems; they blame the issue on you, period.

Our solution would help:- ✨ Enhances conversion rates and minimizes user drop-offs attributed to unnecessary branching in the user flow.

- ✨ Maintains user focus, alleviating cognitive burdens.

-

Although not directly tied to Bearer Tax Invoices,

🧩 our API enables integration of document display and downloading functionality

📱 directly into your website or application.

- 🚚 This eliminates dependence on e-mails, liberating you from potential hassles caused by e-mail service providers.

- ✨ Users are no longer required to input their e-mail into the form, thereby eliminating the possibility of e-mail address typos.

- Additionally, 🚚🛎️ users can easily redownload documents from your application or website, 🪙 alleviating the need for your staff to handle customer inquiries about lost documents.

Click on each scenario to expand the content and see more details.

We hope these two scenarios provide insight into the advantages of Bearer Tax Invoice.

Should you have any further questions or wish to engage in discussions,

please feel free to reach out on our support forum.

As a consumer, what advantages does it offer?

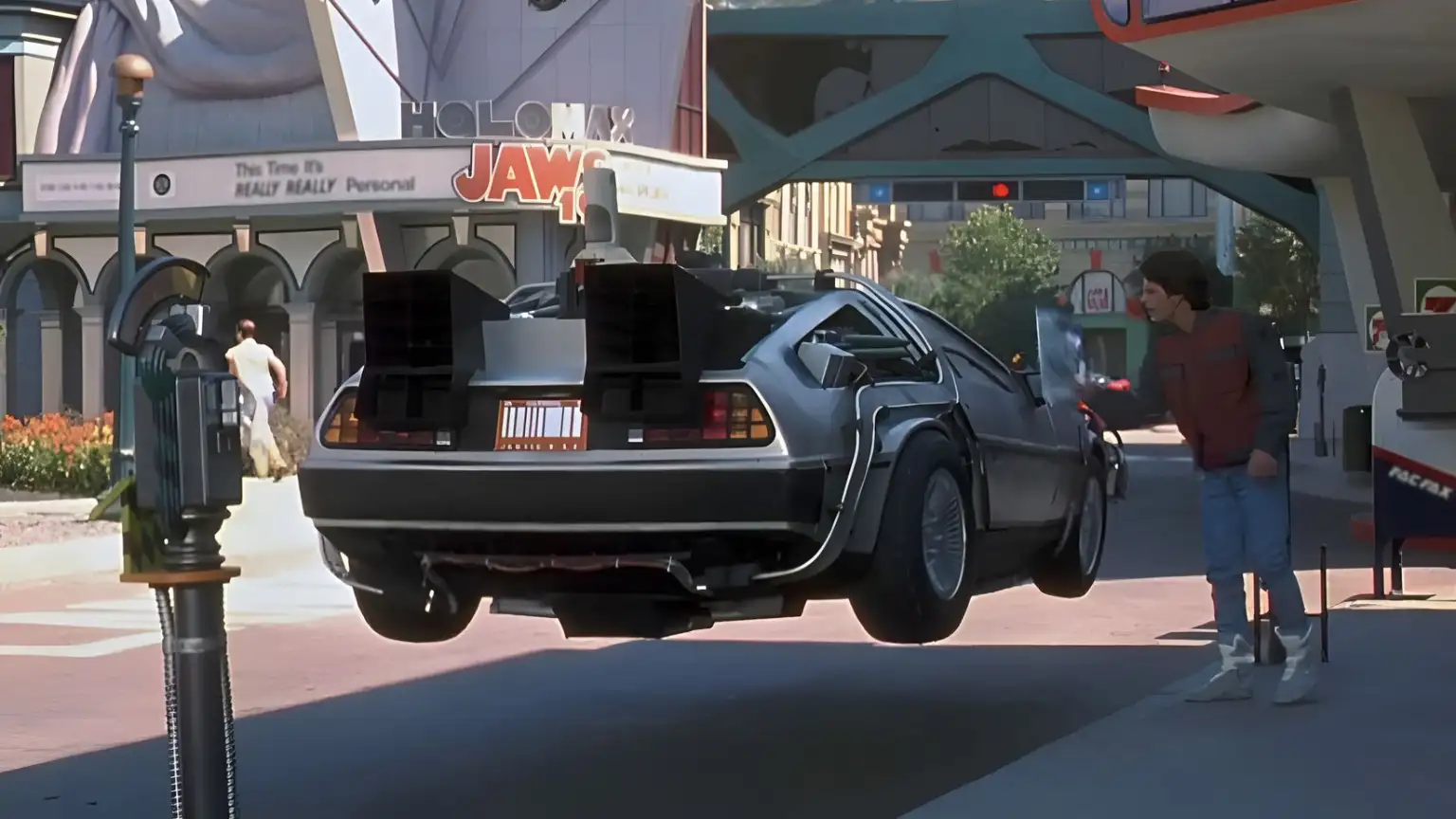

Time Machine exists in movies;

I wonder if something with similar functionality exists in real life.

Lets me explain.

-

Logistics of time: We will transport your decision through time.

Typical tax invoices require an immediate decision on the data to be put on the document; you cannot return to the moment and change the decision.

Bearer Tax Invoices doesn't have the same limitation; it lets you ✨ defer your decision. In other words, it allows your future self to make the decision. Which tends to be better because:- Your future self 🪙 has access to more information than you do.

- 🪙 You are almost guaranteed that your readiness level is at its peak when you decide. You'll not be forced to decide when intoxicated, tired, have a full plate, or something of higher priority.

-

Logistics of duty: We let you delegate the duty to someone else or other entities.

Work-related expenses are inevitable if you are, say, a sales engineer, a pharmaceutical detailer, a consultant at a management consulting firm, or other customer-facing positions.

-

To seek reimbursement from the company,

you typically must request a full tax invoice from vendors when the expense is incurred;

a process not only consumes time but also adds to your duties.

Bearer Tax Invoice simplifies this by allowing you to treat it as a full tax invoice. Just hand it over to the accounting (or reimbursement) team, and you are done; the duty will be delegated to the appropriate team. - This also facilitates better tax allocations through strategic planning. If you have multiple registered companies, it enables strategic expense distribution among your companies' accounts.

-

To seek reimbursement from the company,

you typically must request a full tax invoice from vendors when the expense is incurred;

a process not only consumes time but also adds to your duties.

Let's strike a deal (click) 🏅

- We promised all the benefits we described.

- We are also pricing our services affordably.

- Even if you are not our direct customer, we will let you send us feature requests related to how you can issue full tax invoices; or other things we can help with.

- We ask that you spread the word and advocate for us. We can provide our service, to you, only if the vendors you engage with utilize our services.

Hybrid Tax Invoice

Elevator pitch

Hybrid Tax Invoice bridges the gap between a Bearer Tax Invoice and a paper document,

yielding the benefits of both worlds.

Brief

Hybrid Tax Invoices share

the core concept of Bearer Tax Invoices

but support paper-based abbreviated tax invoices instead of digitally generated ones.

This requires different APIs for system integrations.

In essence, the outcome is

paper abbreviated tax invoices,

each with a QR code to facilitate the reissuing of a full e-TaxInvoice online afterward.

It leverages your existing system to print abbreviated tax invoices

but with the enhancement from us, offering the advantages of both worlds.

For the next generations of 🖥️ POS

Are you considering an upgrade to your POS product offerings?

Look no further—we have the perfect products for you,

with pricing that's appealing to your customers

.

Hybrid Tax Invoice is a product designed with POS vendors in mind.

Integrate with our APIs to elevate your POS system.

We don't mind if you charge your customers

a monthly API connection fee on top of our offering as an add-on to your services.

And remember, our free tier quotas

are available for each of your customers.

As a business owner, how can we integrate our POS system with your APIs?

There are two possible scenarios depending on what type of "business owner" you are.

-

We have a POS vendor; we don't develop our systems in-house.

If this describes your scenario, the viable option is to contact your vendor to incorporate our APIs into the system you utilize.

-

We provide our POS services or develop the POS system ourselves.

If this describes your scenario,

- You may integrate our APIs without the need to contact us.

- But if you have any issues, please discuss them with us.

- Also, once the integration is completed, we can help list your POS solutions on our website as a POS vendor that offers Hybrid Tax Invoices.

Upon successful integration, a new configuration section may emerge in the POS system,

whereby the admin can set up API keys and configurations to enable hybrid tax invoice service from us.

Same benefits as Bearer Tax Invoice

Why so similar?

You can supercharge your business the same way we described in the Bearer Tax Invoice.

They are essentially the same product with different delivery methods.

-

If you are a business owner utilizing POS system

Please kindly read the Bearer Tax Invoice section if you haven't done already, to understand what benefits are in store for you.

If you are in: please contact your POS vendor and inform them about our services.We understand that this can be overwhelming for you, there are lots of parties involved in setting up the system.- Slime Systems (us)

- POS vendor

- The Revenue Department

- certificate authority

-

If you are a consumer

We will promise you the same promise and offer you the same deal as the Bearer Tax Invoice.

If you are in: please contact the business that you want the feature available, and tell them about our services. -

If you are a POS developer

That's great, we are looking forward to work with you. We will helps develop any feature you want.

Wrapping up

Whether you are a strategic leader aiming to empower your staff and satisfy customers,

or a forward-thinking POS or ERP visionary seeking to broaden your offerings,

communication is the key.

e-Receipt

Elevator pitch

There is no way that you are in the business that requires e-Receipts

without a troop of software engineers of your own.

However,

we offer a pre-built Jetpack

that,

⏳ with some little tweaks, will blend in with your existing system;

🪙 this allows your engineering team to shift their focus

from non-core elements to the core value proposition.

Plus, 🧩 our pride lies in system and API designs.

This is akin to 🐕 hiring us as part of your team without committing to long-term salaries,

only the service fee.

Receipt is not the same as tax invoice?

No; and if you are surprised, its time for the explanation.

It's a totally different beast.

There are two similar-looking types of documents;

sometimes, people call them interchangeably,

and there is a good reason behind that.

-

Tax invoice

This is a document primarily related to value-added tax (VAT). When you collect VAT from customers on behalf of the government, it is mandatory to provide them with a tax invoice. Which can be in the form of either an "abbreviated tax invoice" or a "tax invoice." The latter is sometimes dubbed "full tax invoice" to avoid potential confusion.

-

Receipt

Not every business is involved in the VAT collection. Some businesses are exempts from VAT, while others might operate under entirely different taxing schemes.For instance, money lending businesses do not collect VAT but are subject to specific business taxes (SBT). Smaller businesses are often not required to be VAT registered.In the absence of VAT from the transaction, the necessity for issuing tax invoices diminishes, leading to some businesses opting not to register for VAT. Consequently, receipts play a vital role in filling this void.

Consider receipts as a baseline.

When your business is VAT registered, it becomes mandatory to issue a tax invoice.

This tax invoice is also recognized as a receipt, providing a dual purpose in a single document.

This is the reason why both types of documents can sometimes be called interchangeably.

This is the reason why both types of documents can sometimes be called interchangeably.

Why e-Receipt is more difficult than e-TaxInvoice?

When you come to us and mentioned "e-Receipts", there are multiple implications involved.

- As previously discussed, receipts, from a technical standpoint, require less information compared to tax invoices. Notably, they do not include details related to VAT.

- However, it's highly probable that your business operates with a specific-business-taxes scheme, indicating that the business does not fits the VAT scheme.

-

Which imply that you might want to display a whole lot more info than what required in the standard.

- If you are operating a pawn shop, you probably want to display the description of the item used as the collaterals.

- If you are operating a money lending business, you probably want to display account balance after you receives the repayment. Or probably want to includes the info of the current interest rate.

- Specific business comes with specific requirements. I have yet to see the same e-Receipt requirements from two different clients who come up with the requirements on their own without copying one another.

What do you offer?

If the standard theme aligns with your needs,

we provide the same

management API and pricing structure as e-TaxInvoice

with no additional cost.

Detailed information is available on our pricing page

.

Alternatively, 🎨 we offer

custom theme development.

This tailored theme 🏍️ can accommodate non-standard parameters you may require,

and the PDF can incorporate logic (such as conditions - if, else - and loops - for each).

Since the pricing for these customized solutions is variable and subject to discussion,

please feel free to reach out to us via e-mail.

Security features

Amazon KMS integrations

When it comes to your digital signature, your cloud can be mediator for trust.

🔑 We let you store your key on

AWS KMS.

- AWS KMS comply with the 🛡️ FIPS 140-2 standard. And probably all the certifications you ever remember; also they are pretty darn hard on their data center security. Reassured that your private key is well protected.

- By utilizing AWS KMS for your key pair storage, you gain the flexibility to reuse your digital certificate for various purposes. We do not monopolize the certificate; you retain the freedom to sign your digital signature using the AWS KMS API.

- You don't need to trust us; we'll let you set up the key and IAM permissions yourself.

- We never get a hold of your private key, and you cannot even export the private key generated by AWS KMS from Amazon. The key will be generated and securely destroyed within Amazon's hardware security module (HSM), ensuring no human ever sees the private key.

- 📙 Amazon provides auditable logs for every key usage, granting you complete transparency and control over your digital signatures. It's important to note that we cannot manipulate these logs, ensuring their integrity.

Your documents are stored securely.

The documents, too; you don't have to rely solely on trust in us.

We store them using S3-compatible APIs, a de facto industry standard.

Since the API is documented,

you can independently verify the security settings of the bucket

yourself.

Our storage vendors hold relevant certifications and undergo regular audits, too.

JWT API Authentication

We don't authenticate our API by static transmission of API keys.

Instead, we opt to authenticate the entire content of each API request using JWT,

an industry standard;

this has the properties of misuse and misconfiguration resistance.

Plus, since JWT libraries are everywhere,

the integration should be quicker than non-standard formats.

Fine-Grained User Access Control

🪪 Absolutely, we've got it covered.

Experience it firsthand by creating a business group in the console –

our fine-grained user access control is at your fingertips.

Extra features

The little details that make the difference.

Durable storage

We store your document on the storage system with 99.999999999% (eleven nines) annual durability.

📦 Each document is stored on 20 different hard drives in 20 servers,

each server on a different rack connecting to different power supplies and generators;

also, the racks are placed apart in the data centers.

Tossing 14 fair standard dice into the air.

Your house will break down if all of them land on the same side.

Should you be concerned?

If you store 1 million documents for 10 million years, you are expected to

lose 1 document.

The number seems counterintuitive; the explanation is that the risk doesn't accumulate over time;

the occurrence or non-occurrence in one year doesn't impact the chances in the subsequent year.

These numbers are computed based on the underlying probability of multiple events

and not on a Markov model;

also, they do not account for apocalypses or humanity's survival.

Anyway, it means that, when it comes to storage, there's no need to worry;

you are way more likely to win $940 million in a lottery than lose a

document by storage corruption.

Direct app integration

Let's face it: e-mail is an unreliable way, and potentially a bad choice, to deliver important documents.

Our API lets you 📱

integrate document viewing and downloading into your application or

website.

It is there, where you expected it to be.

The placement of the download link is entirely up to you,

but the most common location is

on the order or transaction details screen of your application or website.

Good placement has its advantages.

When customers can easily locate their documents,

🛎️🚚 they can always redownload the file

from there in case they lose the document.

This, in turn, ⏳ frees your staff from managing inquiries about lost documents,

contributing to increased productivity within your organization.

E-mail-agnostic business logic

There is nothing e-mail-related in our offering.

There is no API directly tied to e-mails.

Çılbır: egg farmers never tell you about the menu;

it doesn't mean you are forbidden from making one.

- While the e-mail delivery channel is not endorsed by us, we understand that different situations may call for different measures; hence, we also 🛣️ support every custom delivery method. Within our collection of APIs, 🧩 there are document streaming and downloading APIs. These APIs allow you to either attach the document directly to your e-mail or embed our service URL for 🪙 cost savings in e-mail bandwidth.

- The advantage of using e-mail-agnostic APIs is that you retain complete control over the content in the e-mails. 🪙 You have the flexibility to generate them as you see fit, e.g., personalized experiences for each of your users.

- All of your e-mail securities will be left intact. We won't ask you to modify SPF, DKIM, or DMARC records.

- And, of course, we did not charge for something we did not do. There will be no e-mail-related fee.

- We never use e-mail addresses to authenticate your customers. While some competitors might employ this method, we intentionally avoid it, opening up more possibilities for you to explore.

-

To understand the

drawbacks of customer e-mail authentication,

let's examine the approach taken by one of our competitors.

They provide a feature similar to Bearer Tax Invoice, in the part of embedding a QR code and a link into the document. However, they utilize e-mail addresses for authenticating the owner of the abbreviated tax invoice (though this may change in the future; competition is ever-evolving).

- This necessitates customers to switch between two applications: the one issuing the tax invoice and their e-mail client. While not a deal-breaker, it may not be optimal for user experience.

- Additionally, it limits the possibility of ownership transfer; the owner is designated by the e-mail address even on an abbreviated tax invoice.

It's essential to highlight that there is no definitive right or wrong method; our approaches, as well as those described, represent the different ways to achieve something. Depends on your preference, having multiple options might be advantageous for you. (And yes, we have our authentication mechanism as well, sans e-mail.)

Custom theme development

Certainly, we offer 🎨 custom theme development, too.

However, it's worth noting the existing

collection of standard (community) themes

you can utilize without additional cost,

although presently, only one theme is available.

The "retail-hatsu" theme emphasizes simplicity

and

allows you to 🏍️ customize the main color to align with your brand's color

scheme.

Feel free to get in touch with us to explore the possibility of introducing a new community theme

(at no cost) or to discuss custom theme developments.

Our signature: everything APIs

Hi there, we are new kids in town; it's nice to meet you.

We don't do a whole lot of of things, but we made one thing the best,

API.

We take pride in each API we ship; you might find one of the missing pieces you need in our hands.

- If there's a feature that you find missing but wish to add, you have the freedom to do so. Even if our APIs don't include the desired feature by themselves, we are sure 🛣️ you will make it happen.

- You are welcome to do things your way. 🛣️ You're not obligated to utilize everything we offer; simply take what you need.

- We don't make promises that others might, and we don't integrate with other systems on your behalf; but we will ensure you can do it yourself. 🧩 We promise that our API will support whatever you try to accomplish.

- 🧩 When it comes to our APIs, 🏍️ you can discuss anything with us; we can add new features fast. 🐕 Count us as one of your team.

- We'll be right there with you, 🫱🏻🫲🏽 wherever your imagination takes you — whether you've built a stellar POS system, innovative ERP software, or something novel that we've yet to encounter.

- We aim to foster positive relationships with all and are open to exploring 🫱🏻🫲🏽 potential partnership opportunities. Count us out of underhanded tactics to crush the competition — after all, 🌱 the last thing we want to crush is Thailand's ecosystem. Feel free to initiate discussions on any topic; we're open to collaboration and dialogue.

- 🌱 Let's grow together; you won't regret adding us to your list of partners.

What's the next step?

The path forward depends on your preferences, it boils down to three choices:

- Dive into the documentation if you prefer delving into details before embarking on the journey.

- Explore our pricing if budget considerations are on your mind.

- Take the plunge and experience it firsthand if you prefer a hands-on approach and getting into the nitty-gritty.